We've had agreat time working with our clients in the Sacramento area and interacting with them via this blog.

However, we have decided to focus our business on the Reno/Tahoe area due to overwhelming volume and the impractability of travel times involved servicing both areas.

If you are in the Sierras, Reno, Lake Tahoe, or Northenr Nevada please visit us at http://www.qbdoc.com and http://www.custmbiz.com

Tuesday, June 23, 2009

Wednesday, November 5, 2008

Just a Quick Question? Try QB on Call!

QB On Call

Stuck on what should be a simple problem?

Tired of calling tech-support for hours of the "run around?"

Looking for an affordable way to simply "fix it?"

Then call us!

Our knowledgeable experts can assist you with many common QuickBooks "quick questions."

We speak YOUR language and can guide you through most solutions with simple, easy to understand assistance.

We are QuickBooks Users and Consultants....We use QuickBooks Everyday!

If you are tired of call centers and can't find expert help in your area, give us a call...we now offer $49 single incident, 30 minutes or less, support.

We've been doing this for many years locally and now we're going world-wide. Call us between 10 am -9 pm PST with your credit card & your issue.

We'll take an incident report, run your credit card for a flat fee of $49.00 and either call you back or, if you would like to wait while we process your credit card payment, we'll stay on the line and start your "support clock" once payment has been made.

We limit our calls to One Incident - One Topic; limited to 30 minutes. You can't call asking how to create an invoice, then move on to payroll issues. But you can call if you need operational support from real bookkeepers, users & hands-on consultants.

This is QuickBooks User support...architectural or software issues that require engineering support are not included. If your questions are not within our field of expertise, we'll tell you and we won't ask for your credit card.

If you are having installation issues, don't forget that you may have free installation support from Intuit, so use that first!

So, if you are looking for real support from real QuickBooks users Call the Pros at QB On Call!

QB On Call

A Division of Custom Business Solutions

"The QuickBooks Gal"

1755 E Plumb Lane, Ste 101

Reno, NV 89502

Labels:

call,

questions,

quickbooks,

support

Wednesday, September 24, 2008

New! QuickBooks Point of Sale Website!

We are pleased to announce the launch of our new website focussing primarily on our Point of Sale and Retail Solutions clients. http://www.qbdoc.com/ is the place to get more information on Point of Sale hardware, software, and services. We are proud to have been chosen by intuit to be the only Retail Solutions Providers in Northern Nevada and look forward to offering expert point of sale service to retailers in Reno, Lake Tahoe, the Sierras and nearby California communities.

To celebrate the new offerings from Intuit - including the revolutionary new Cash Register Plus - we have listed some special offers on our website.

Here are the details of our Cash Register Plus bundle deal:

Time to update that old, slow cash register? Don't need to track inventory?

Call us about the NEW Cash Register PLUS!

Get a NEW HP Computer, Monitor, the Cash Register Plus software and all the POS Hardware you need from us for $1,499.00 when you use Innovative Merchant Solutions for credit card processing

Simplify everyday retail tasks by organizing them all in one place.

Ring up sales and accept credit card payments** Track customer information to provide better service. Run reports that give you key insights into your businessBalance your cash drawer quickly and accurately with a simple wizard. Save time on bookkeeping by transferring data right to QuickBooks*** Simple screens that look just like a cash register make it easy to learn and use. Cash Register Plus, lets you do all of this right on your own PC*. You’ll spend less time running around and more time running your business.

*See system requirements for PC. Cash drawer, receipt printer and credit card swipe sold separately.

**Service is optional. Requires a merchant account through Intuit Merchant Services for Intuit Cash Register Plus. Application approval, fees and additional terms and conditions apply. Internet access required.

***Works with QuickBooks Simple Start, Pro and Premier editions (2006-2009) and QuickBooks Enterprise Edition (Versions 6.0-9.0). Sold separately.

Monday, August 25, 2008

Here Comes Quicken 2009!

We just received the official email from Intuit - QuickBooks 2009 is now available for sale. They have also given us a link to allow our visitors to save up to 36% and get free shipping. Quite a deal!

We look forward to getting our copy in the next few days and kicking the tires, but Quicken just seems to get better every year and this year should be no exception. They say there is no major redesign - which means no large learning curve - just minor improvements and upgrades, such as including more banks in their online banking feature.

We look forward to getting our copy in the next few days and kicking the tires, but Quicken just seems to get better every year and this year should be no exception. They say there is no major redesign - which means no large learning curve - just minor improvements and upgrades, such as including more banks in their online banking feature.

Friday, August 22, 2008

How to Unapply Credits

Recently, one of our Reno QuickBooks customers asked about "unapplying" credits in QuickBooks. While there are nicely labelled apply credits buttons, there are none marked unapply. This is the case for both customers (invoicing) and vendors (paying bills).

So here is how it is done:

For customers, it is a fairly easy process. Go to the invoice to which the credit was applied. Then click on the "Apply Credits" button. In the lower half of the new window that pops up is a list of Previously Applied Credits. Simply find the one, or ones you wish to unapply and click on the check mark next to it to make the check mark disappear. The credit will no longer be applied or tied to that invoice.

For Vendors, i.e. bill payments, it is not as clean and simple. The only way to unapply a credit in such a case is to Delete the credit. You can then re-enter the credit for future use and it will no longer be applied to that specific bill.

To delete the credit, go to your Vendor Center, click on the name of the Vendor, make sure the "Show" drop down menu says All Transactions, then find the Credit in the list and double click it. Once it is open you should write down or print any of the information you'll need to re-enter it later, then click on the Edit menu and click on "Delete Credit."

Friday, June 27, 2008

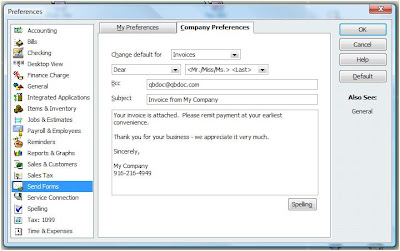

Need a copy of sent emails?

Until the most recent version of QuickBooks, which finally let us integrate the QuickBooks email function with Microsoft Outlook, one of the biggest frustrations of QuickBooks users who use the email function in Quickbooks was that once something was sent it was essentially gone. There was no way to go back to a "sent" folder and take a look at the notes that had been typed in messages to clients or vendors. Sure, you could look up the original invoice, p.o., etc. But you couldn't find the content of your message.

Of course, if you are like some of our clients who don't like using Microsoft Outlook for email - then you still have this frustration as well.

Unless, you use this great tip:

In your Preferences, go to the "send forms" section. Click on "Company Preferences," and then add your email address to the "Bcc" field. This will send a copy of every email you send out of QuickBooks to you, blindly, so that your customers & vendors aren't even aware that you are doing this. You may want to even set up a specific email address that you use only as your virtual "sent" box if you send a high volume of forms from QuickBooks.

Of course, if you are like some of our clients who don't like using Microsoft Outlook for email - then you still have this frustration as well.

Unless, you use this great tip:

In your Preferences, go to the "send forms" section. Click on "Company Preferences," and then add your email address to the "Bcc" field. This will send a copy of every email you send out of QuickBooks to you, blindly, so that your customers & vendors aren't even aware that you are doing this. You may want to even set up a specific email address that you use only as your virtual "sent" box if you send a high volume of forms from QuickBooks.

As always, we hope this tip has been helpful. If you need more in-depth QuickBooks assistance, don't hesitate to contact our QuickBooks ProAdvisors in Reno at 775-348 9225 or our QuickBooks ProAdvisors in Sacramento at 916-216-4949.

Labels:

bcc,

email,

outlook,

quickbooks,

Reno,

Sacramento

Tuesday, May 27, 2008

Peachtree 2009 is available now!

While we focus much more on QuickBooks than Peachtree here in this blog, it is worth pointing out that the new version of Peachtree has just been released and is now available for purchase. We have only had a few days with it, but so far, the 2009 release is a significant improvement over prior versions of Peachtree.

Below are some of the new feautures Peachtree touts on their website. We look forward to using the product and giving a more thorough reviewe in the weeks to come.

New Features of Peachtree Complete Accounting 2009

Multi-Year Reporting*

Compare budgets and financial results across multiple years within your General Ledger reports and Financial Statements. As your business grows over the years, you will be able to use this functionality to get improved trending analysis, better research, and more accurate forecasts based on prior year activity.

Flexible Payroll Management

Access to a flexible payroll management tool for your business is available. Peachtree 2009 makes managing your payroll easier with set-up improvements and expanded offerings for benefits and deductions. These expanded feature improvements offer you a better way to account for items that you need to effectively manage your business.

Real-Time Error Alerts

Having data accuracy is critical to any small business. Within Peachtree, you will be alerted when using non standard AP and AR accounts upon saving the transaction or when using a non-cash account in the cash account field on receipts and payments.

Cash Flow Management

Easily analyze and forecast your cash flow with the use of the cash flow management tool. You will have the ability to know whether or not you will have enough cash to meet current and upcoming financial obligations by managing your cash flow from one location. Additionally, you will be able to export cash flow forecasts into Microsoft Excel.

Time and Expense Tracking

Peachtree 2009 allows you to locate your time and expense tickets through a quick list view, utilize a new invoice form specific for your industry, as well as customize the first day of your business week depending on how your company tracks time.

* See www.peachtree.com/disclosures for details

Subscribe to:

Posts (Atom)